Table of Contents

Introduction

Investing in AI (Artificial Intelligence) has become an increasingly popular strategy for individuals looking to maximize their profits and generate passive income. As someone who has personally benefited from AI investments, I can attest to the tremendous potential it holds.

What is AI?

AI refers to the development of computer systems capable of performing tasks that would typically require human intelligence. These systems are designed to acquire, process, and analyze vast amounts of data to provide valuable insights and make informed decisions.

The Importance of AI in Today’s World

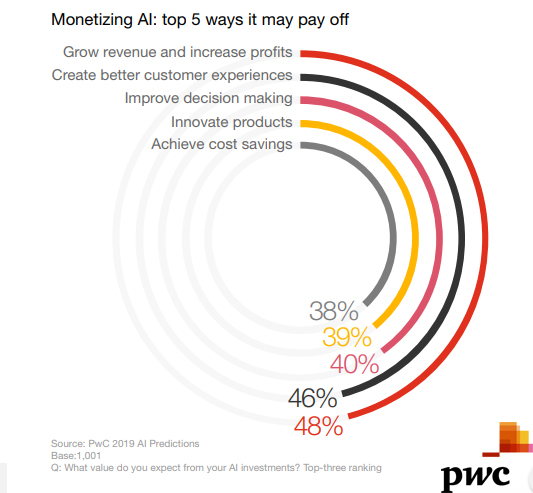

With the exponential growth of data and technological advancements, AI has emerged as a game-changer in various industries. From healthcare to finance, AI has revolutionized the way businesses operate and make strategic decisions. Its ability to uncover patterns and trends that humans may overlook makes it a powerful tool for maximizing profits.

Investing in AI can be highly lucrative as it allows individuals to capitalize on the opportunities presented by data-driven decision-making. By leveraging AI algorithms and models, investors can identify market trends, predict stock prices, and optimize their investment portfolios.

AI investments provide an incredible opportunity to maximize profits and generate passive income. With its ability to analyze vast amounts of data and make informed decisions, AI has become an essential asset in today’s world. By embracing this technology and leveraging its power, individuals can position themselves for financial success.

Maximizing Profits with AI Investments

Artificial Intelligence (AI) has revolutionized the way we live, work, and invest. As an investor, I have discovered that AI investments offer a lucrative opportunity to maximize profits and generate passive income. In this article, I will explore the different types of AI investments and discuss the benefits they bring.

Understanding AI Investments

AI investments encompass a range of opportunities, including investing in AI companies, AI-driven funds, and AI technologies. These investments leverage the power of machine learning, predictive analytics, and data analysis to identify trends, forecast market movements, and make strategic investment decisions.

Types of AI Investments

When it comes to AI investments, there are various options available. One popular option is investing in AI-driven funds. These funds are managed by AI algorithms that analyze vast amounts of data to identify investment opportunities. Another option is direct investment in AI companies, which can provide significant returns as AI becomes more prevalent in various industries.

Benefits of AI Investments

AI investments offer several benefits. Firstly, AI-driven algorithms can process vast amounts of data quickly and accurately, enabling investors to make informed decisions in real-time. Secondly, AI investments have the potential to identify market trends and generate higher returns compared to traditional investment strategies. Additionally, AI investments offer the advantage of diversification, as they can analyze multiple markets and sectors simultaneously.

AI investments present a unique opportunity to maximize profits and create passive income. By understanding the different types of AI investments and leveraging their benefits, investors can tap into the potential of this rapidly growing field and secure their financial future.

Factors to Consider Before Investing

Investing in AI can be a lucrative strategy to generate passive income and maximize your profits. However, before diving into this exciting realm, it is crucial to carefully consider a few factors. By conducting thorough research, analyzing market trends, and assessing potential risks, you can make informed investment decisions that will greatly impact your financial success.

Researching AI Companies

Begin by delving into the world of AI companies. Familiarize yourself with the leading players in the industry, their backgrounds, and the technologies they specialize in. Look for companies with solid track records, innovative products, and a clear vision for future growth. By exploring their financial statements, market positioning, and client base, you can gain valuable insights into their potential for generating substantial returns.

Analyzing Market Trends

Stay abreast of the latest trends and developments in the AI and big data sectors. Consider how technological advancements and shifts in consumer behavior may impact the profitability of specific AI investments. By identifying emerging subfields within AI, such as robotics, machine learning, or natural language processing, you can capitalize on the next big opportunities before they become mainstream.

Assessing Potential Risks

Every investment carries inherent risks, and AI is no exception. Therefore, it is crucial to evaluate potential risks carefully. Consider factors such as regulatory changes, ethical concerns, and the possibility of disruptive innovations that could render certain AI technologies obsolete. Diversification is also key to manage risk effectively – spreading your investments across different companies and sectors can mitigate potential losses.

maximizing profits with AI investments requires careful consideration and research. By researching AI companies, analyzing market trends, and assessing potential risks, you can make sound investment decisions that have the potential to yield substantial returns. Stay informed, stay diversified, and embrace the exciting world of AI for a prosperous financial future.

Strategies for Maximizing Profits

Investing in AI can be a lucrative venture, offering the potential for both short-term gains and long-term passive income. By utilizing machine learning algorithms and tapping into the power of big data, investors can optimize their investment strategies for maximum profitability.

Diversifying AI Investments

To minimize risk and maximize returns, it is crucial to diversify AI investments across various sectors and industries. By spreading investments across multiple AI companies, technologies, and applications, one can mitigate the impact of any potential downturn in a specific area. Diversification allows for exposure to different market conditions and increases the chances of capturing maximum growth opportunities.

Long-term vs. Short-term Investments

When it comes to AI investments, the right balance between long-term holds and short-term trades is key. Long-term investments allow ample time for the technology to mature and generate substantial returns. On the other hand, short-term trading enables investors to capitalize on market fluctuations and take advantage of timely opportunities. Achieving a balanced portfolio by incorporating both approaches can result in a well-rounded investment strategy.

Utilizing Machine Learning Algorithms

Harnessing the power of machine learning algorithms can give investors an edge in the AI market. These algorithms can analyze vast amounts of data, identify patterns, and make data-driven investment decisions. By leveraging these algorithms, investors can make informed choices, identify promising investment opportunities, and increase their chances of maximizing profits.

by diversifying AI investments, striking the right balance between long-term holds and short-term trades, and utilizing machine learning algorithms, investors can position themselves best to maximize their profits in the thriving world of AI investments.

Case Studies of Successful AI Investments

Company A: Transforming Industries through AI

One of the most remarkable success stories in AI investments is Company A, which has completely transformed industries through the implementation of cutting-edge artificial intelligence technologies. By leveraging AI algorithms and big data analytics, Company A has revolutionized various sectors, including finance, e-commerce, and transportation. Their AI-driven solutions have enabled streamlined operations, enhanced customer experiences, and optimized decision-making processes. For instance, in the finance industry, their AI-powered trading platforms have consistently outperformed conventional strategies, resulting in significant profit gains for investors. This success can be attributed to their advanced machine learning algorithms that analyze vast amounts of data to identify trends and patterns, facilitating more accurate predictions and faster decision-making.

Company B: Revolutionizing the Healthcare Sector

Another outstanding example of successful AI investments can be seen in Company B’s endeavors to revolutionize the healthcare sector. By employing AI technologies, Company B has developed groundbreaking medical diagnostic tools that have improved patient care and medical outcomes. Through the analysis of complex patient data, their AI algorithms can swiftly identify diseases, predict treatment responses, and provide personalized healthcare recommendations. This has led to reduced errors in diagnosis, enhanced treatment efficiency, and ultimately, better patient outcomes. Moreover, Company B’s AI innovations have also played a crucial role in drug discovery, significantly accelerating the development and testing processes. This remarkable progress not only benefits the company financially but also provides a promising future for healthcare advancements.

These case studies demonstrate the immense potential AI investments hold in maximizing profits while positively impacting numerous industries. As more organizations embrace the power of AI, the opportunities for wealth creation and passive income through these investments continue to expand.

Potential Challenges in AI Investments

Ethical Concerns in AI

When it comes to investing in AI, one of the potential challenges one may face is the ethical concerns surrounding this emerging technology. AI algorithms make decisions based on data, and if the data used is biased or flawed, it can lead to discriminatory outcomes. As an investor, it is crucial to consider the ethical implications of the AI technologies you choose to invest in. Ensuring that the AI companies you support adopt ethical practices and promote fairness is essential for sustainable and responsible investing.

Evolving AI Technology

Another challenge in AI investments is the ever-evolving nature of this technology. AI is constantly advancing, and what may be considered cutting-edge today could become outdated in a matter of months. As an investor, it is crucial to stay updated with the latest developments in AI to identify investment opportunities that have the potential to generate the highest returns. Continuously monitoring the progress of AI technology, attending industry conferences, and networking with experts in the field will help you make informed investment decisions.

while AI investments offer exciting opportunities for maximizing profits and generating passive income, it is essential to navigate potential challenges. Considering the ethical concerns surrounding AI and staying updated with the ever-evolving technology will enable you to make informed investment decisions that align with both your financial goals and your ethical values. By actively addressing these challenges, you can position yourself for success in the rapidly growing field of AI investments.

The Future of AI Investments

Investing in artificial intelligence (AI) has become an increasingly attractive option for individuals looking to maximize their profits and generate passive income. As AI continues to reshape industries and enhance business processes, it presents a wealth of opportunities for savvy investors.

Emerging Trends in AI Investments

AI technology is rapidly evolving, and with it, investment opportunities abound. Machine learning algorithms, natural language processing, and robotics are just a few of the emerging trends in AI investments. These technologies have the potential to revolutionize sectors such as healthcare, finance, and transportation, opening up new avenues for investors to capitalize on.

Expanding Opportunities

One of the key advantages of AI investments is the sheer range of opportunities available. From investing in AI startups to purchasing shares in established companies that are leveraging AI technology, there are various ways to tap into the potential for high returns. Additionally, investing in AI funds or index funds that specifically target the AI sector can provide diversified exposure to this rapidly growing field.

As AI investments continue to gain momentum, it is crucial for investors to stay informed about the latest trends and developments in the field. By keeping a close eye on industry research, attending conferences, and networking with experts, investors can position themselves to make informed decisions and maximize their profits in the exciting world of AI investments.

Conclusion

In conclusion, harnessing the power of AI investments can lead to a significant increase in profits and help individuals achieve their financial goals. Through the utilization of advanced technology and data analysis, AI has revolutionized the investment industry, providing new opportunities for maximizing returns.

Harnessing the Power of AI Investments

By leveraging AI algorithms and machine learning techniques, investors can make informed decisions based on real-time data. This enables them to identify profitable investment opportunities and mitigate risks effectively. AI can analyze vast amounts of data far more efficiently and accurately than humans, resulting in more successful investment strategies.

Realizing Financial Growth

Investing in AI technologies, such as automated trading systems or AI-powered robo-advisors, can lead to substantial financial growth. These platforms use sophisticated algorithms to identify trends and predict market movements, ensuring that investments are strategically placed to optimize returns. Additionally, AI can continuously adapt and learn from market fluctuations, adjusting investment strategies accordingly.

Maximizing profits with AI investments requires a deep understanding of market trends and technological advancements. It is crucial to stay up-to-date with the latest AI developments and continuously analyze investment strategies for optimal results.

By embracing AI investments, individuals can unlock a wealth of opportunities to generate passive income, increase their financial portfolio, and achieve long-term financial stability. With the right knowledge, tools, and mindset, anyone can tap into the potential of AI investments and secure a brighter financial future.