Table of Contents

Introduction

Welcome to my article on maximizing profit through the utilization of AI algorithms in finance. In today’s fast-paced and ever-evolving world, finding ways to generate income and achieve financial stability is crucial. One such method gaining popularity is using artificial intelligence (AI) algorithms to analyze financial data and make profitable investment decisions.

The Power of AI in Finance

AI algorithms have revolutionized the finance industry by providing accurate and efficient tools for decision-making. These algorithms are designed to process vast amounts of financial data in real-time, identify patterns, and make predictions based on historical trends. By leveraging AI algorithms, investors can make informed decisions, minimize risks, and maximize profitability.

Optimizing Investment Strategies

When using AI algorithms in finance, one can achieve remarkable results by optimizing investment strategies. These algorithms can analyze market trends, identify emerging opportunities, and make predictions about future market movements. By carefully considering the recommendations of AI algorithms, investors can adjust their investment portfolios to take advantage of these opportunities, ultimately increasing their chances of making profitable trades.

Risk Management

In addition to maximizing profit, AI algorithms also play a crucial role in risk management. They can analyze market volatility, identify potential risks, and provide early warnings to investors. By incorporating risk management strategies suggested by AI algorithms, investors can minimize losses and protect their investments.

Understanding AI Algorithms

With the rapid advancements in technology, artificial intelligence (AI) has emerged as a game-changing tool in the financial industry. One of the key applications of AI in finance is the development and utilization of AI algorithms to maximize profit and generate passive income. In this section, I will provide a comprehensive understanding of AI algorithms, their definition, and different types.

Definition of AI Algorithms

AI algorithms refer to the set of mathematical instructions or rules that enable AI systems to analyze and process vast amounts of data, identify patterns, and make informed predictions or decisions. These algorithms are designed to mimic human intelligence, learning from data and adapting their behavior accordingly. By leveraging AI algorithms, financial institutions can gain valuable insights into market trends, optimize investment strategies, and ultimately maximize profits.

Types of AI Algorithms

There are various types of AI algorithms commonly used in finance, each with its unique purpose and functionality. Some of the widely employed ones include supervised learning algorithms, unsupervised learning algorithms, reinforcement learning algorithms, and genetic algorithms. Supervised learning algorithms analyze labeled historical data to predict future outcomes accurately. Unsupervised learning algorithms, on the other hand, identify patterns and relationships within a dataset without prior labeling. Reinforcement learning algorithms learn through trial and error, constantly adapting their strategies based on feedback. Lastly, genetic algorithms employ evolutionary principles to optimize complex financial models by mimicking the process of natural selection.

understanding AI algorithms is crucial to effectively leverage their power in the financial industry. By harnessing the potential of these algorithms, businesses can make better-informed decisions, generate passive income, and ultimately maximize profits.

Applications of AI Algorithms in Finance

Artificial Intelligence (AI) algorithms have revolutionized the financial industry, offering numerous opportunities to maximize profit and generate passive income. By harnessing the power of AI, individuals and businesses can make informed decisions backed by intelligent analysis and prediction. In this article, I will explore some of the key applications of AI algorithms in finance, highlighting how they can be utilized to enhance profitability.

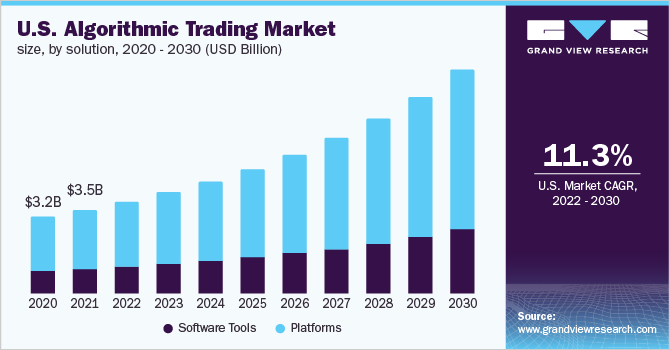

Automated Trading Systems

AI algorithms have transformed the way trading is conducted, enabling the development of automated trading systems. These systems use advanced algorithms to analyze massive amounts of data, identify trends, and execute trades at lightning speed. By eliminating emotional biases and making swift decisions based on real-time market analysis, automated trading systems can significantly boost profits.

Algorithmic Investment Strategies

Another area where AI algorithms excel is in the development of algorithmic investment strategies. By leveraging historical data, market trends, and other relevant factors, AI algorithms can identify optimal investment opportunities and create strategies that generate consistent returns. These strategies can adapt to changing market conditions, ensuring that investments remain profitable over time.

Risk Assessment and Management

AI algorithms play a crucial role in assessing and managing risk in the financial sector. By analyzing vast amounts of data, including market trends, economic indicators, and historical patterns, these algorithms can identify potential risks and assess their potential impact. This allows investors and financial institutions to make informed decisions and implement effective risk management strategies to mitigate losses and maximize profits.

Fraud Detection and Prevention

The financial industry is vulnerable to various types of fraudulent activities. AI algorithms can help in detecting and preventing fraud by analyzing large datasets, monitoring transactions, and identifying suspicious patterns. By quickly identifying fraudulent activities, financial institutions can take prompt action to prevent monetary losses and maintain the integrity of their operations.

AI algorithms offer a wide range of applications in the financial sector, enabling individuals and businesses to maximize profit and generate passive income. From automated trading systems to algorithmic investment strategies, risk assessment, and fraud detection, AI algorithms provide powerful tools for enhancing profitability in the ever-evolving financial landscape.

Benefits of Utilizing AI Algorithms in Finance

In today’s rapidly evolving financial landscape, it is crucial for businesses and individuals to stay ahead when it comes to maximizing profit. One way to achieve this is by harnessing the power of AI algorithms in finance. These cutting-edge technologies offer a multitude of benefits that can greatly enhance decision-making, efficiency, accuracy, and profitability.

Improved Decision-Making

AI algorithms have the remarkable ability to analyze vast amounts of data and identify patterns that may not be immediately apparent to human analysts. By processing this information, AI algorithms can provide valuable insights that can inform more informed and strategic financial decisions. Whether it’s predicting market trends or identifying investment opportunities, AI algorithms can help businesses and individuals make more intelligent choices, maximizing their chances of profitability.

Enhanced Efficiency and Accuracy

The automation capabilities of AI algorithms are a game-changer in terms of efficiency and accuracy. AI-powered financial systems can rapidly execute complex calculations, analyze large datasets, and generate comprehensive reports at a speed and scale that surpasses human capabilities. This not only saves time but also minimizes the risk of human error, ultimately leading to more reliable and precise financial outcomes.

Reduced Human Error

Human error can have significant consequences in the financial world. AI algorithms can minimize these risks by eliminating subjective biases and emotional factors that often interfere with decision-making. With AI-powered systems handling critical financial processes, such as risk analysis and portfolio management, there is a higher degree of objectivity and consistency, reducing the likelihood of costly mistakes.

Increased Profitability

At the end of the day, the ultimate goal of utilizing AI algorithms in finance is to maximize profitability. By leveraging advanced data analytics and predictive modeling, AI algorithms can identify hidden patterns, optimize investment portfolios, and identify potential revenue streams that may have been overlooked by conventional methods. This leads to improved financial performance and the potential for higher returns on investment.

Harnessing the power of AI algorithms in finance has become increasingly favored by businesses and individuals seeking to maximize their profits. By leveraging the benefits of improved decision-making, enhanced efficiency, reduced human error, and increased profitability, AI algorithms offer a competitive edge in the fast-paced and ever-changing financial landscape. So, whether you’re a seasoned investor or a business owner, it’s worth considering how AI algorithms can help you reach your financial goals.

Challenges in Implementing AI Algorithms in Finance

Data Privacy and Security Concerns

One of the major challenges in utilizing AI algorithms in finance is the concern over data privacy and security. With AI relying heavily on vast amounts of data, there is always the risk of unauthorized access or breach of sensitive information. As a result, stringent measures need to be implemented to safeguard data and ensure the privacy of customers’ financial information. Robust encryption protocols and firewalls are essential components of any AI system in finance.

Lack of Regulatory Frameworks

Another challenge is the lack of regulatory frameworks specifically tailored to AI algorithms in finance. As this technology continues to evolve rapidly, regulatory bodies are struggling to keep up with the pace. This creates ambiguity and uncertainty, potentially hindering the widespread adoption of AI in the financial sector. It is crucial for regulatory authorities to establish clear guidelines and standards to facilitate the responsible implementation of AI algorithms.

Ethical Implications

AI algorithms in finance raise ethical concerns, particularly when it comes to decision-making processes. There is a possibility of biases being coded into the algorithms, leading to unfair treatment or discrimination. It is important to address these ethical implications and ensure that AI algorithms are transparent and accountable. Regular audits and oversight by human experts are necessary to mitigate any unethical practices.

Cost of Implementation

Implementing AI algorithms in finance can be costly. It requires substantial investments in infrastructure, hardware, and software systems. Hiring skilled professionals to develop and maintain the algorithms also adds to the overall cost. However, the potential benefits of maximizing profit through AI make it a worthwhile investment in the long run.

In order to fully harness profitable AI algorithms in finance, the industry must address these challenges and find effective solutions. By prioritizing data privacy and security, establishing regulatory frameworks, addressing ethical implications, and considering the cost of implementation, we can unlock the full potential of AI in finance. The future holds immense opportunities, and it is essential that we navigate these challenges with care and diligence.

Considerations for Successful Integration of AI Algorithms

Quality and Quantity of Data

One of the key considerations in maximizing profit by utilizing AI algorithms in finance is the quality and quantity of data available. As the saying goes, “garbage in, garbage out.” AI algorithms rely on vast amounts of data to make accurate predictions and generate profitable insights. Therefore, it is essential to ensure that the data used is of high quality, relevant, and comprehensive. Investing in data collection and cleansing processes is essential to maximize the effectiveness of AI algorithms.

Choosing the Right Algorithm

Selecting the appropriate AI algorithm is crucial for successful integration in finance. There are various algorithms available, each with its strengths and weaknesses. It is important to evaluate the specific requirements, goals, and constraints of the financial scenario at hand when choosing an algorithm. This entails considering factors such as accuracy, speed, interpretability, and scalability to ensure optimum performance and profitability.

Training and Fine-Tuning

Once the algorithm is selected, training and fine-tuning become vital steps. AI algorithms continually learn and improve through exposure to diverse datasets and real-world scenarios. Adequate training enables algorithms to adapt to changing market conditions and increases their accuracy in predicting financial outcomes. Fine-tuning helps optimize the algorithm’s performance, ensuring maximum profitability.

Monitoring and Evaluation

Regular monitoring and evaluation of AI algorithms are essential to identify potential issues, assess their performance, and make necessary adjustments. By closely monitoring the algorithm’s output, I can ensure its accuracy and reliability. Additionally, continuous evaluation enables me to identify any deviations or anomalies promptly, minimizing potential risks and maximizing profit potential.

By carefully considering the quality and quantity of data, choosing the right algorithm, investing in training and fine-tuning, alongside proper monitoring and evaluation, I can successfully integrate AI algorithms into my finance strategy and maximize my profits.

Case Studies: Successful Implementation of AI Algorithms in Finance

Company A: Transforming Trading Strategies

One of the most impactful applications of AI algorithms in finance has been in the field of trading strategies. Company A, a pioneering finance firm, successfully implemented AI algorithms to identify high-probability trades and optimize their investment decisions. By leveraging machine learning capabilities, they were able to accurately predict market trends and capitalize on profitable opportunities.

The algorithms utilized historical data, real-time market information, and intricate patterns to generate reliable trading signals. This enabled Company A to enhance their trading strategies, resulting in significantly increased profits and minimized risks. The ability to analyze vast amounts of data with lightning speed gave them a competitive edge in volatile markets, making AI algorithms an indispensable tool for financial success.

Company B: Revolutionizing Risk Management

Another area where AI algorithms have proven to be highly effective is risk management. Company B, a prominent financial institution, adopted AI algorithms to revolutionize their risk assessment processes. By analyzing extensive data sets, including market trends, economic indicators, and even social media sentiment, they were able to predict and mitigate potential risks with greater precision.

These algorithms provided Company B with valuable insights to identify potential threats, assess their impact, and develop proactive risk-management strategies. As a result, they were able to minimize losses, improve portfolio performance, and optimize their risk-to-reward ratio.

these case studies demonstrate the tremendous potential of AI algorithms in the finance industry. By utilizing advanced technology to analyze data and make informed decisions, companies like Company A and Company B have successfully maximized their profits and created sustainable passive income streams. The transformative power of AI algorithms in finance is undeniable, offering immense opportunities for wealth creation and financial stability.

Conclusion

In conclusion, utilizing AI algorithms in finance can be an effective strategy for maximizing profit and creating passive income. By leveraging the power of artificial intelligence, individuals and businesses can gain valuable insights and make data-driven decisions that can significantly impact their financial outcomes.

The Benefits of AI Algorithms in Finance

One of the main advantages of using AI algorithms in finance is their ability to analyze and process vast amounts of data in real-time. This enables them to detect patterns, trends, and anomalies that traditional analysis methods might miss. By identifying these insights, AI algorithms can help individuals and businesses make more informed investment decisions, minimize risks, and optimize their overall financial strategies.

AI Algorithms as a Tool for Predictive Analytics

AI algorithms also excel in predictive analytics, using historical data to forecast future market trends and outcomes. This enables users to identify potential investment opportunities and adjust their investment portfolios accordingly. Through machine learning, AI algorithms continuously learn and improve their predictions, adapting to changing market conditions and increasing their accuracy over time.

The Importance of Monitoring and Adjusting AI Algorithms

However, it’s important to note that AI algorithms are not foolproof and require ongoing monitoring and adjustment. While AI can automate the investment process and reduce human bias, it still requires human oversight to ensure the algorithms are delivering the desired results. Regular performance evaluations and adjustments based on market changes are essential to maximizing the effectiveness of AI algorithms in finance.

By combining human intelligence with the power of AI algorithms, individuals and businesses can harness the potential for maximizing profit and creating passive income in the ever-evolving financial landscape. With careful analysis, continuous monitoring, and adaptation, AI algorithms can be a valuable tool for achieving financial success.